Worcestershire SME engineers growth plans with £650K finance deal from Time Finance

Invoice Finance: £250k Confidential Facility

Asset Finance: £400k Facility

Location: Midlands

Sector: Engineering

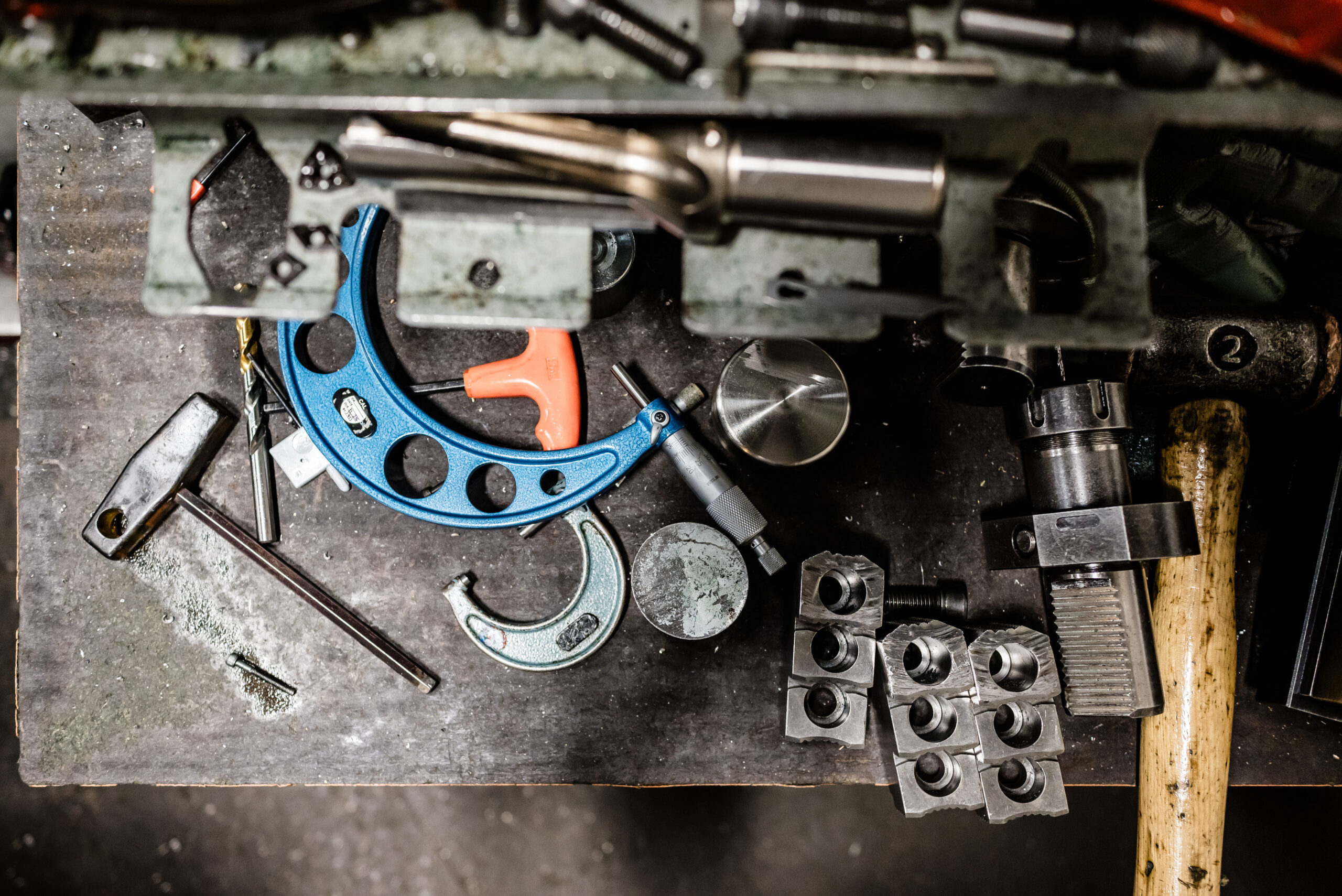

SpeedFlex Engineering is a Midlands based company who specialise in the manufacture of components for the aerospace, automotive and gas turbine industries.

The current owner, Stephen Dunstall, undertook an MBO in 2016 buying out the previous owner upon their retirement. He had worked for the business from 2003 and had expanded his role and responsibilities during that time.

Under his management, Stephen had watched SpeedFlex grow from a £500k turnover business to £1.6m. The business was experiencing a slight downturn and was looking to reevaluate their borrowings, as well as refinance the CNC machines they had with another Asset Finance provider.

What we did

As a conscientious business owner, Stephen was already researching alternative solutions to help alleviate the costs associated with the existing lending he had in place. Stephen’s aim was to reduce risk on a personal level and also to help consolidate the company’s finance position. The existing lenders wanted him to secure his home against the funding, but he wasn’t comfortable with the proposals offered. He subsequently contacted ‘The Directors Choice’, an SME assistance platform, who pointed him in the direction of Time Finance.

In need of a multi-product facility, we were able to provide Invoice Finance and Asset Finance specialists to discuss his individual requirements. Working together, they were able to provide cheaper, less risky funding solutions to Stephen.

Speaking about the deal and the process he went through, Stephen commented: “The team at Time Finance work differently to those lenders who I’ve dealt with before. They have a human approach to the solutions they provide. Working with Rob Walters and Sam Evans was easy, they are personable, friendly and we had open and honest conversations about my needs, those of the business and my plans for the future.”

“Not only was it easy to work with the chaps from Time, but they turned both the Invoice Finance and Asset Finance deals around in just three weeks. I needed it in place by Christmas and they did just that. Nothing was too much trouble and the whole thing happened really smoothly.”

Outcome of the facility

The solution we provided Stephen, and his business will now provide him with access to greater funding limits and the ability to reduce his outgoings. He is now planning his future growth chapter safe in the knowledge he has given his business the financial breathing space to do so.