Press Releases | Time Finance

Our Time Finance press centre provides you with our latest news. For media enquiries, contact our press office on press@timefinance.com

Independent SME lender Time Finance has packaged a £500,000 multi-product solution for Manchester based CCTV and security firm, Red Security.

The unique multi-product solution consisted of a £250k Confidential Invoice Finance Facility, and a £400k Asset Finance Facility, allowing the business to invest in its operations and prioritise growth plans.

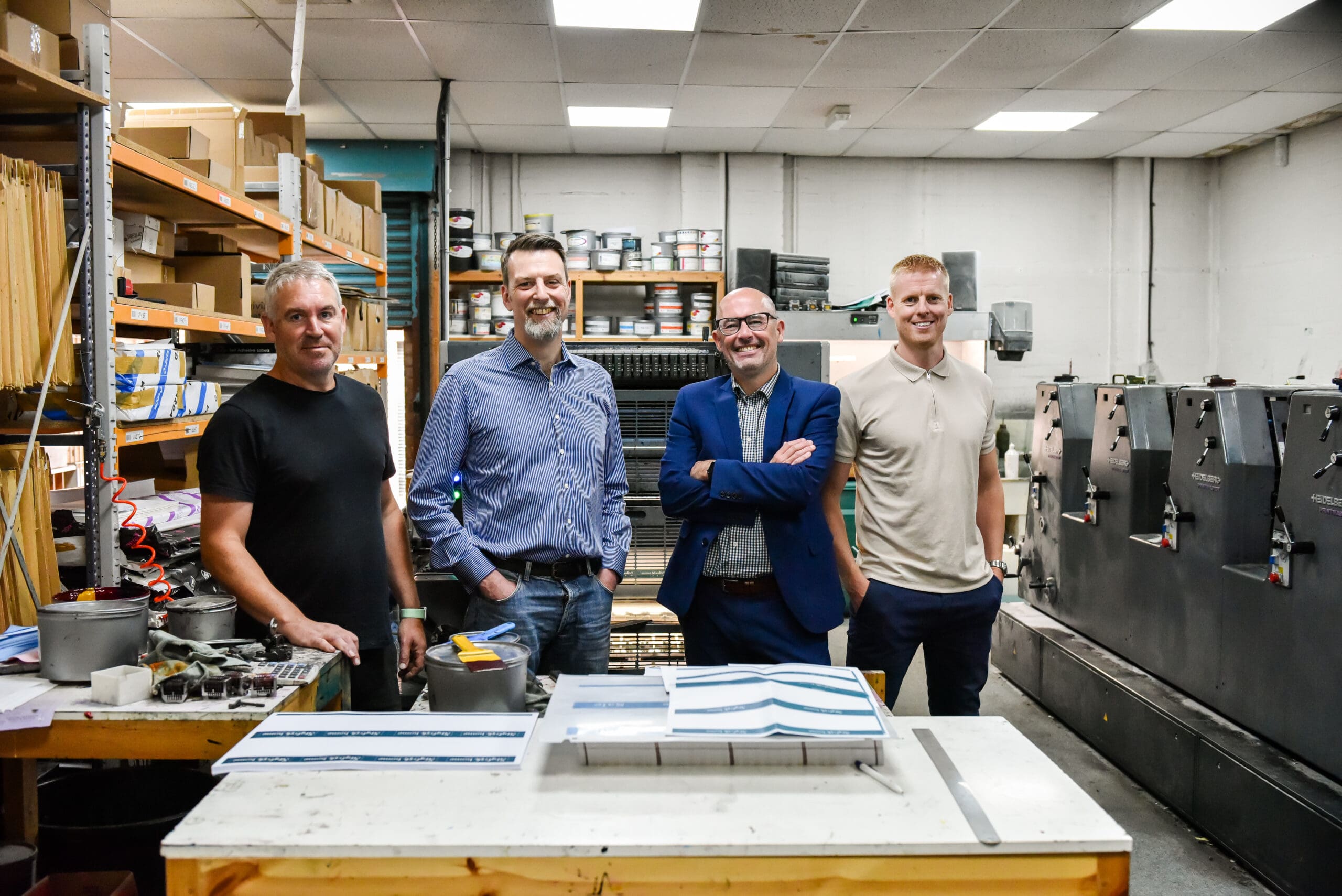

Set and Match Ltd, a Birmingham-based SME specialising in digital and traditional print, has its sights set on future growth having completed a management buyout thanks to our Asset-Based Lending (ABL) deal.

Time Finance, the alternative finance provider, has renewed its block discounting facility from Cynergy Business Finance (CBF), the asset-based lending (ABL) arm of Cynergy Bank, increasing the facility to £15m.

Time Finance, the alternative finance provider to UK SMEs, has achieved another lending milestone with the delivery of its first Asset Based Lending (ABL) facility.

Time Finance is pleased to announce that it has reached a record high in its lending book, as it hits a £145m milestone of funding support delivered to UK businesses.

Time Finance is pleased to announce the launch of its new Asset Based Lending (ABL) solution, designed to help UK businesses access funds otherwise tied up in assets within their business, including plant and machinery, stock, and commercial property.

Time Finance are delighted to announce that they have introduced a new Secured Lending product to support the growth and investment plans of British businesses throughout 2022 and beyond.

Time Finance are delighted to announce that they have secured Sharon Bryden as Director of Commercial Loans & ABL with immediate effect. The role is newly created and is reflective of the firms’ commitment to delivering a market leading portfolio of funding solutions to UK businesses as they recover and grow.