Why Invest in Time Finance?

Proud to empower 10,000 UK businesses with funding solutions

Increased Profitability, £5.9m pre-tax profit in FY23/24 up from £4.2m in FY22/23

Our loan book continues to increase. FY23/24 up 18% vs FY22/23

Operating in a wide range of sectors providing diversification of risk

Senior Management Team with over 150 years of experience in lending to UK businesses

A trusted brand with a strong value set

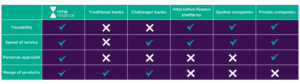

Why we stand out?

Take a look at our share price performance

Regularly updated prices can be viewed on the London Stock Exchange Website: TIME FINANCE PLC TIME Stock | London Stock Exchange

The above information has been disclosed pursuant to Rule 26 of the AIM Rules for Companies. Information last updated 25th September 2024.

Latest News

In her new role, Kelly will focus on expanding Time Finance’s reach across Birmingham and the West Midlands as well as Staffordshire, Shropshire and Cheshire, by building relationships with a wider network of intermediaries and supporting more SMEs with flexible funding solutions.

Read More

SoilEx, an environmental construction waste management specialist, has its sights set on expansion with the support of a £450k Invoice Finance facility from independent lender, Time Finance.

Read More

Independent SME lender, Time Finance, has teamed up with verifi to launch a new virtual asset inspection platform as part of its ongoing investment to improve its finance solutions for SMEs.

Read More