Multi-Product Solutions

What does a Multi-Product Solution provide

Multi-Product Solutions or as it’s formally known, Asset Based Lending (ABL) gives you access to vital funds by using your existing assets as collateral – from invoices and stock, to property and machinery. Our multi-product solutions can be tailored to address your unique requirements, whilst releasing a higher level of working capital than other forms of finance. A multi-product facility can help support your future business growth plans.

How it Works

We’ll meet you face-to-face to discuss your funding requirements.

We’ll determine what level of funding we can make available to you.

We’ll send a proposal and quote for a multi-product funding solution.

You’ll receive the funds to support your business growth.

You make agreed payments dependent on the solution.

What are the benefits?

A multi-product solution can benefit your business plans in a number of ways.

- Access to higher availability of working capital.

- Funding grows in-line with your business.

- A fast and cost-effective way to fund growth.

- Enables Management Buy-Outs (MBOs) and Management Buy-Ins (MBIs).

- Also supports mergers and acquisitions.

Who will multi-product solutions help?

Businesses with multiple assets often find an Asset Based facility to be an ideal solution for securing crucial funding. It can help businesses across a wide range of sectors including, but not limited to, the following:

- Manufacturers

- Wholesalers and Distributors

- Engineering

- Haulage and Transport

- Printers

Why choose a multi-product loan?

- SMEs can unlock cashflow against assets in the business, which allows for immediate access to liquidity and enable the business to invest in day-to-day operations, staffing growth costs and acquisitions.

- The ‘one-stop-shop’ aspect of ABL means business owners only need to approach one asset-based lender to acquire the funding needed with one solution rather than multiple from various lenders. This massively decreases the stress and time required in researching and contacting different funders.

- Our multi-product solutions offer a solution-focused approach, working with a team dedicated to tailoring a solution to attend to a business’s unique needs.

Frequently Asked Questions

It’s a simple way to bring together the value of the assets within the business to maximise a larger release of cash for you to use to take your business forward.

It could be used for a specific outcome, such as management buy-out or restructure. It can be used to simply release more cash into the business.

We look at the cash you have tied up in a property, machinery or unpaid invoices and structure the mix that offers you the greatest funding potential via Invoice Finance, Asset Finance and Bridging Finance

You can borrow from £100k up to £5m based on a combined range of the assets available in the business.

We will take into account your sales ledger and confirmed order book, any plant, machinery or vehicles as well as property and land.

With multi-product solutions, your business can borrow from £100k up to £5m.

Each product will require some level of security. This will be based on the assets and funding amounts.

Latest Multi Product News

Time Finance is expanding its support for UK SMEs with an increase to its Invoice Finance and Asset Based Lending (ABL) maximum facility limits which have risen to £5m.

Read More

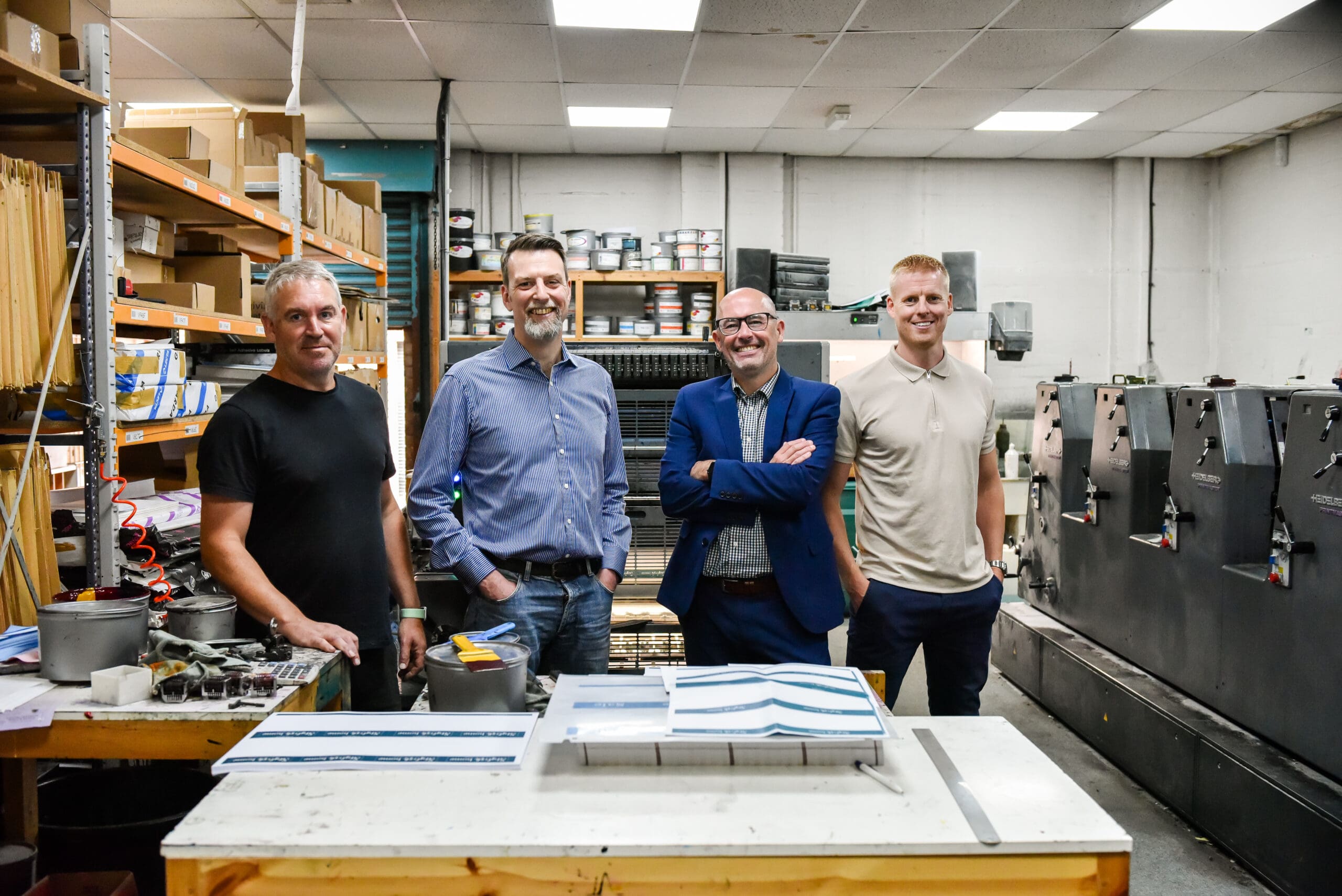

The unique multi-product solution consisted of a £250k Confidential Invoice Finance Facility, and a £400k Asset Finance Facility, allowing the business to invest in its operations and prioritise growth plans.

Read More

Set and Match Ltd, a Birmingham-based SME specialising in digital and traditional print, has its sights set on future growth having completed a management buyout thanks to our Asset-Based Lending (ABL) deal.

Read More