Commercial printer presses ahead with management buyout following funding from Time Finance

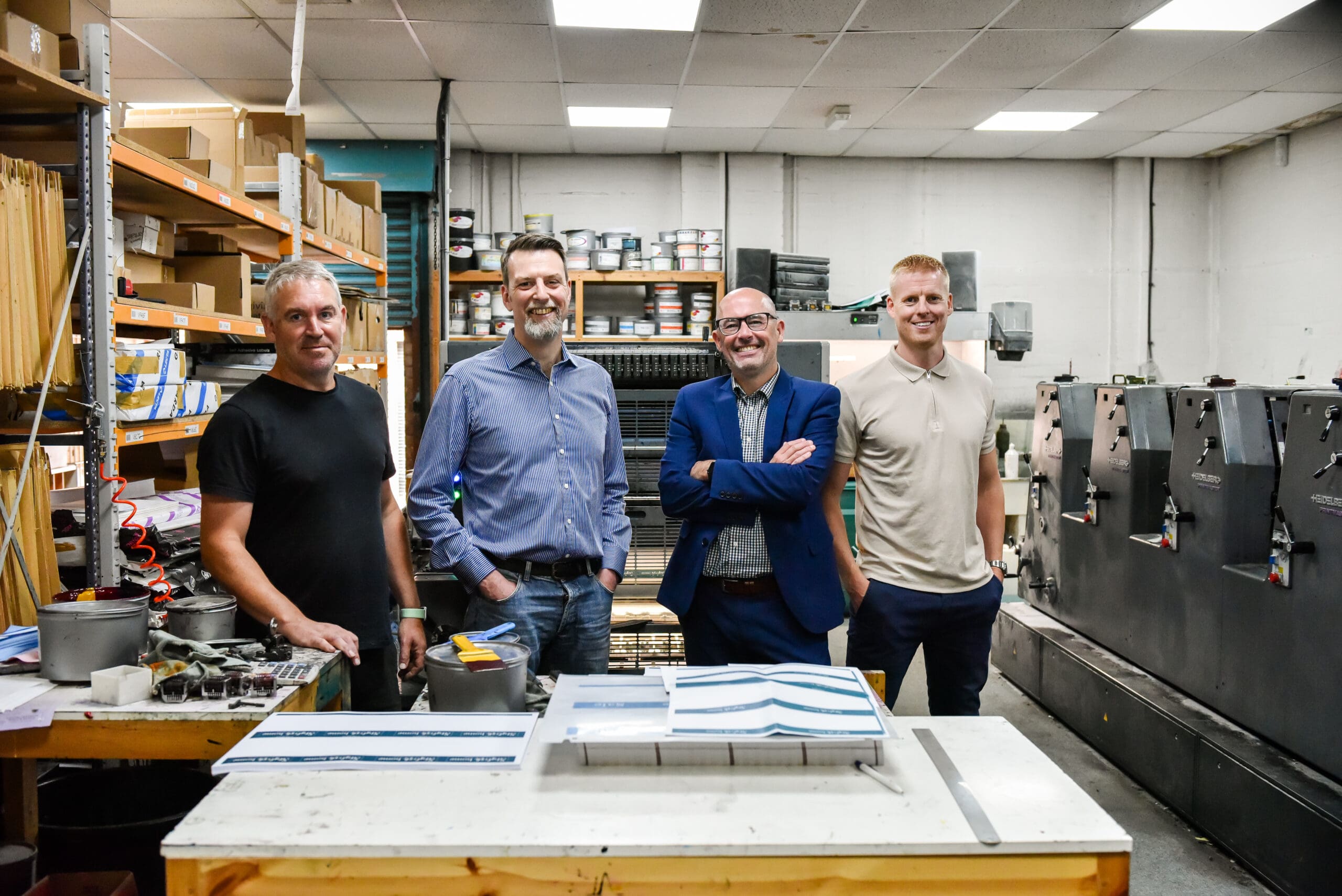

Set and Match Ltd is a Birmingham-based SME printing company. The business aims for future growth. It recently completed a management buyout, made possible through an Asset-Based Lending (ABL) deal with us.

The deal consists of a £70k Invoice Finance facility and a £70k Secured Loan. This management buyout funding has enabled Managing Director Stuart Mills to buy out existing shareholders. As a result, he can now take the business forward in an ever-changing commercial landscape.

Our broker partner, Paul Varley at Navigate Commercial Finance, facilitated the £140k ABL deal. ABL is typically associated with larger deals which makes this funding package unique.

Our Business Development Manager, Rob Walters, commented, “When we were introduced to Stuart, it was assumed that he would need a loan to complete his buyout due to the size of his business. However, Asset-Based Lending is a solution that many SMEs don't explore. This is because traditional lenders typically offer this funding in much larger sums.

“We break that mould at Time Finance; we are always looking to tailor our solutions to business needs. ABL deals can be structured from £25k to £3.5m. That gives small businesses scope to explore other options outside of more traditional forms of finance such as loans.” If you want to understand how Asset-Based Lending can benefit your business, take a look at our asset-based lending solutions.

Unlocking working capital with ABL Solutions

Launched in 2022, our ABL solution helps businesses unlock working capital. It releases funds tied up in existing assets, such as machinery, equipment, stock, commercial property and invoices.

Stuart Mills, Managing Director of Set and Match, added, “I had never come across ABL as a funding solution, despite being a business owner for over 20 years. However, it makes perfect sense to utilise the assets already within the business. This flexible funding solution allows me to complete my share purchase and continue funding and growing my company.”

Paul Varley, Managing Director of Navigate Commercial Finance, said, “I’m delighted to have played a part in supporting Stuart and Set & Match with their next phase of growth. A well-run progressive business that can now kick on under Stuart’s ownership supported by the right funding partner in Time Finance.”

Established in 1992 by John Mills and Jim Reely, Set and Match originally specialised in typesetting, moving into traditional printing with the purchase of a print business in 2002.

The management buyout funding will now enable Stuart to merge the two businesses (Colprint and Set & Match) and own Set and Match outright, focusing on growing print services.