Our Clients | Time Finance

We’re proud to support the ambitions of UK businesses at Time Finance. We work with a diverse range of clients, providing critical funding to fuel their growth.

SoilEx, an environmental construction waste management specialist, has its sights set on expansion with the support of a £450k Invoice Finance facility from independent lender, Time Finance.

Discover how we supported this client through a successful restructure with a £1.6 million multi-product facility.

Discover how we funded this wholesaler with a £2.75 million multi-product facility to support them through a challenging period.

Discover how we provided this recycling business with a £1 million invoice finance facility to help them rebuild after a devastating fire.

Independent SME lender Time Finance has packaged a £500,000 multi-product solution for Manchester based CCTV and security firm, Red Security.

Learn how we helped this West Midlands Meat Product Manufacturer secure a £1 million Invoice Finance facility to help them enter a new market.

SpeedFlex Engineering is a Midlands based company who specialise in the manufacture of components for the aerospace, automotive and gas turbine industries.

Discover how we helped this East Midlands haulage business secure a £1.65 million Asset-Based Lending (ABL) facility to expand their storage operations.

Discover how we supported this West Midlands haulage company with £270,000 Asset Based Lending facility, driving forward growth and success.

Our ability to offer a bespoke, multi-product solution ultimately positioned this family owned bakery for continued success in a challenging market.

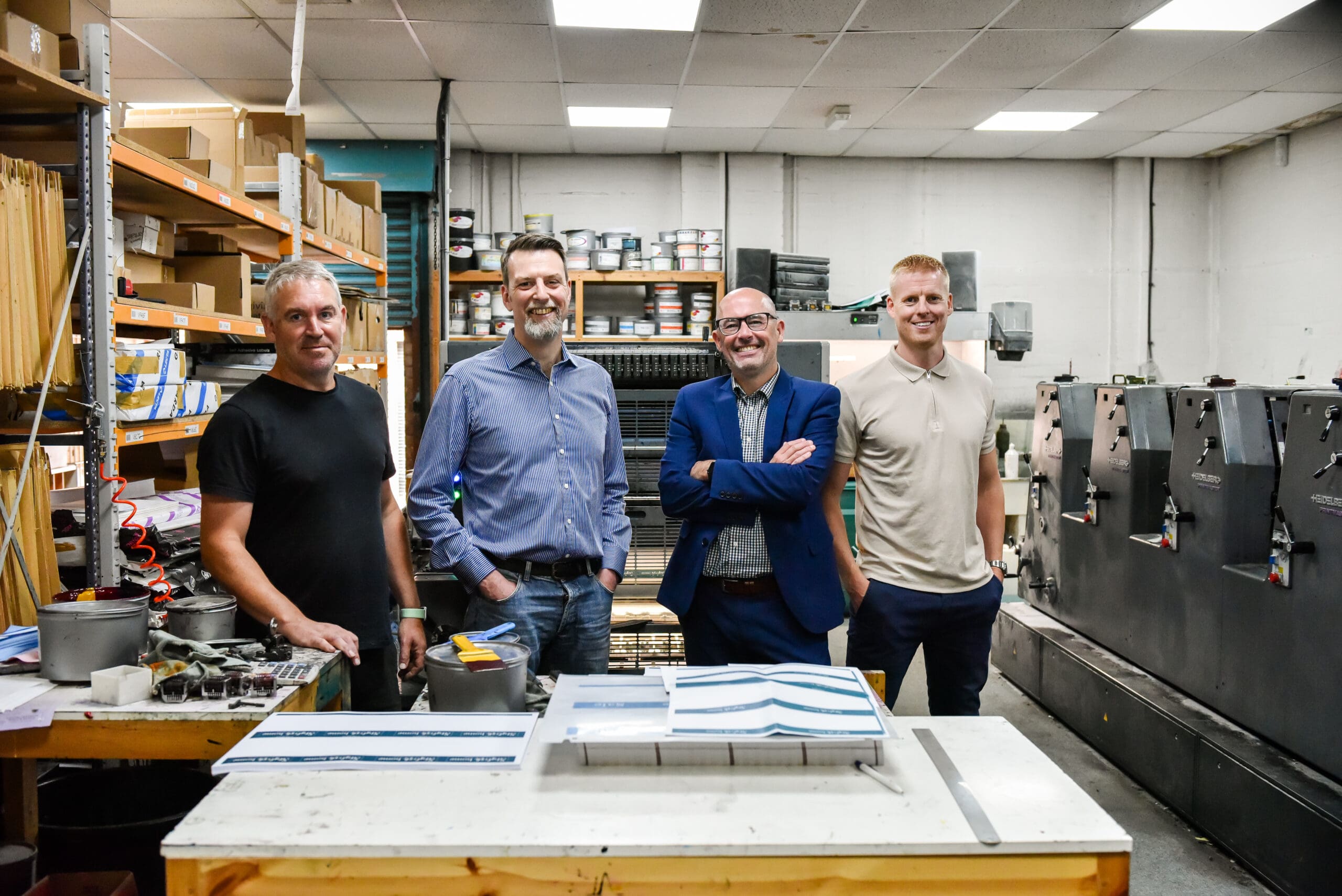

Set and Match Ltd, a Birmingham-based SME printing company, has its sights set on future growth having completed a management buyout thanks to an Asset-Based Lending (ABL) deal with us.

Two Drifters, a Devon-based distillery that featured on the last ever Hairy Bikers episode, is set for major growth having secured a £100,000 funding facility from Time Finance.

Time Finance is pleased to announce the successful completion of a £900,000 Asset Based Lending (ABL) facility which has been used to facilitate the management-buy-in (MBI) of established wastewater services provider Active Pump Services Limited.

Time Finance and Evolve Business Finance are pleased to announce they have facilitated a six-figure funding boost for a family-run haulage business.

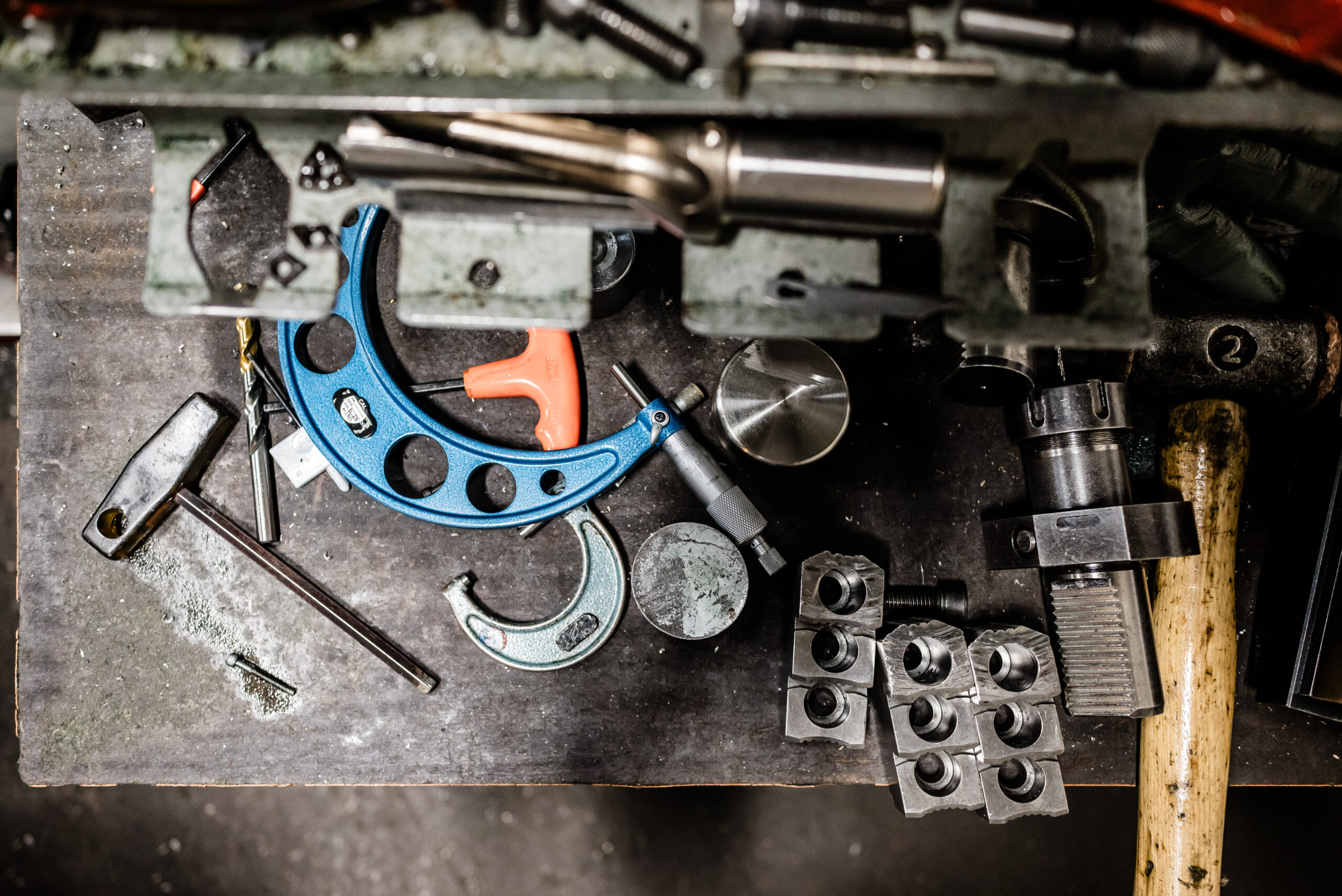

Time Finance is pleased to announce it has supported precision engineering firm, DARL Engineering, with a £58,500 asset finance facility to accelerate its investment in new and leading machinery.

Time Finance is pleased to announce it has supported leading connectivity and business managed services partner, Connectus Business Solutions, with a new Invoice Finance funding line that will help accelerate growth.

Time Finance and Open InVoice Finance are pleased to announce that they have delivered a £1.1million Asset Based Lending (ABL) facility to aid the expansion of a growing steel structural engineering firm in the South East of England.

Norwich-based energy consultancy, Indigo Swan, has secured a six figure invoice finance facility with Time Finance to accelerate its investment in sustainability and its support for the UK’s decarbonisation journey.

Time Finance and Goodman Corporate Finance are pleased to announce that they have delivered £2million of funding support to a growing site logistics and labour supplier in the South East of England.

Global fitness brand, HITIO Gym, are excited to announce they have launched their second UK site thanks to funding support from Time Finance.

Time Finance supported their client, Rendit, with a £350,000 Invoice Finance facility as they used the funds to fuel further innovation and growth.

Time Finance proudly supported their client, Kidds Transport, with a £600,000 funding boost as they put their ambitious growth plans into gear.

Time Finance supported A & B Contractors with a £750,000 Invoice Finance and £100,000 XtraTime facility, to help harvest their ambitious growth plans.

Time Finance supported a mechanical and electrical engineering firm, Scorpion ES, with a £200,000 Invoice Finance facility to help spark future growth plans.

Time Finance supported family-owned business, Vertical Rigging, to drive their growth strategy forward with a Vehicle Finance funding solution.

Find out how Time Finance helped Lakes Carpet Cleaning Solutions secure an Invoice Finance solution to help the business through the COVID-19 crisis.

Time Finance helped Better Indoors, an indoor air quality and ventilation specialist, secure business funding to service rapidly increasing demand.

Time Finance helped recruitment agency Zest Education secure a six-figure funding facility to drive their ambitious plans forward and create more jobs.

Time Finance supported Dominique Tillen under the Coronavirus Business Interruption Loan Scheme (CBILS) to boost her business, Brush-Baby, during the pandemic.

Read more about how Time Finance supported a creative arts firm with an £80,000 facility under the Coronavirus Business Interruption Loan Scheme (CBILS).

Time Finance supported fashion & textile manufacturer, LS Manufacturing, with a £400,000 cashflow finance facility to manufacture essential PPE for the NHS.

Find out how a new fleet of leased vehicles supplied by Time Finance for Lancashire-based business, SEP Rail Services, helped to drive their business forward.

Time Finance supported Limchester Properties in investing in a new buy-to-let property after helping them remortgage their existing property portfolio.

Time Finance helped Welsh-based cheese manufacturer Blaenafon of Cheddar invest in vital specialist equipment through Asset Finance.

Time Finance supported North West recycling firm AC Tyres with a £100,000 loan facility under the Coronavirus Business Interruption Loan Scheme (CBILS).

Time Finance supported family-run car dealership, Lowton Motor Company, with £150,000 CBILS Loan to drive the business through the covid-19 crisis and beyond.